Revenue Approved

EIIS Investment Opportunity 2025

EIIS, or the Employment Investment Incentive Scheme, serves as a catalyst for SMEs and start-ups in Ireland. It helps companies raise investment while delivering tax savings + returns for investors. In a nutshell, an investor benefits from a healthy 35% tax relief on their investment. As an example, when you invest €10,000 the actual cost is only €6,500 and you can expect a payout of €13,000 over the 4 year period.

Avoid negative bank interest rates with our inflation busting investment opportunity.

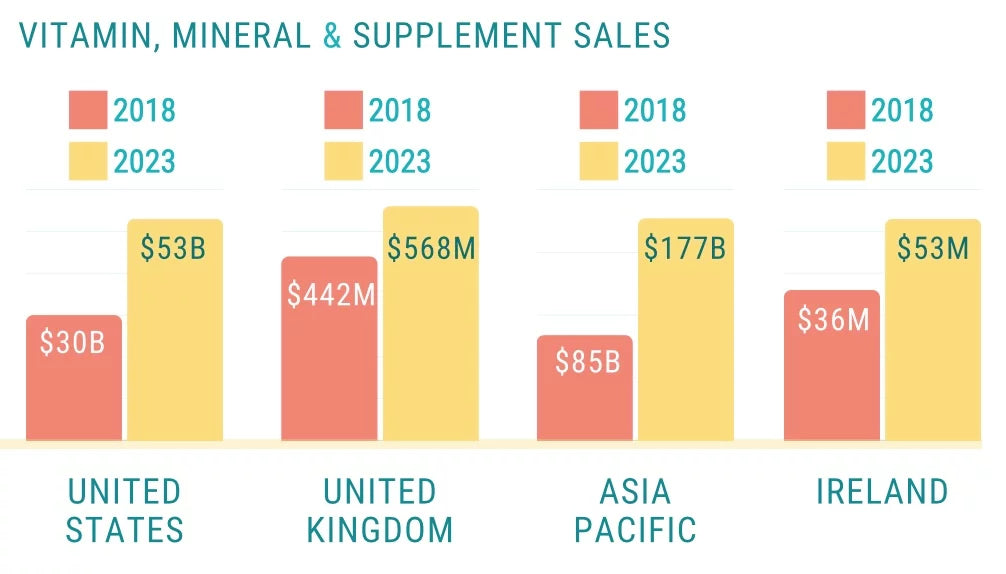

The staggering growth in Digital Health investment has increased from $1.2 Billion in 2010 to $44 Billion in 2022

StartUpHealth.com

Talk to Us

Call Jonathan today: 085 777 8262 | Email: info@wildatlantichealth.com

Please complete your details to receive a Summary of the EIIS Investment Opportunity 2025.

Invest In Your Health & Wealth

-

Company: Wild Atlantic Health Ltd

Company Reg No:627 336

Location: Cork, Ireland

Sector: Preventative Health Tech

Stage: Revenue Generating / Scaling

EIIS: Revenue Approved Scheme -

A unique selling point of the scheme is that tax relief isn’t confined to pension contributions. It extends to non-earned income sources such as dividends and rental income. So, it’s not just about investing, it’s about investing smartly.

-

- Investors must have taxable Irish income and cannot be connected to the company.

- The minimum investment period is 4 years.

- Investors can invest up to €500,000 per year over a 4 year investment period.

- Investment to a maximum of €500,000 per annum is possible provided the shares are held for a minimum of 7 years.

Rooted in Wellness Backed by Science Personalised to You

Post-Covid, we are seeing a convergence of trends encompassing Digital Health, Sustainability and Personalised Nutrition.

Wild Atlantic is the first company in Ireland to offer a painless home test to measure deficiencies and then back this up with lifestyle recommendations and supplements that really work.

We are seeking to raise investment to rapidly grow the business in the Irish market to replicate the model in international markets. So if you’re an investor interested in health, sustainability and backing the business – we’d love to tell you more about our EIIS Investment Opportunity 2025.

Target Raise: €500,000

Tax Relief: 35% Tax Back in 2026 for qualifying Irish taxpayers

Targeted Return 25% per annum (including tax relief at the marginal rate)

Amount: Minimum €5,000

Maximum €500,000 each per individual in a marriage or civil partnership.

Type: Ordinary Shares

Closing: 31st December 2025

FAQs for EIIS Investors

FAQs

What is the EIIS scheme?

The Employment and Investment Incentive Scheme (EIIS) offers tax incentives to private Irish investors who provide qualifying small and medium-sized enterprises (SMEs) risk capital.

It is one of the few remaining income tax reliefs available, covering total income tax relief, including rental income and tax due on employee share options.

This scheme aids these companies in securing the necessary funding to grow their operations and maintain or create job opportunities. EIIS is attractive for individual investors who can claim up to 35% tax relief upfront on their investment.

How To invest in EIIS?

There are several approaches to participating in the EIIS scheme:

- Directly with the company with no fees and at affordable amounts dealing with the Directors of the Company

- Via Accounting Firms with 3% commissions and annual fees.

- Through an EIIS fund with initial amounts between €10,000 and €20,000 at a nominal fee of around 3%. Possible 6-9 months waiting period to deploy funds and fees on exit

- Crowdfunding Platforms have low entry investments from €250 and offer higher tax relief, but are typically early stage and riskier propositions.

How do you qualify for the EIIS scheme?

An investment to be eligible under the EIIS, it must be a share-based investment in a qualifying company. The funds raised should be utilised to aid job creation and growth of the company. Furthermore, the investment should be anchored on a detailed and well-outlined business plan.

What tax relief do investors actually get?

The investor earns up to 35% relief on their income taxes. The investment amount can be deducted from gross income for income tax purposes.

How do I claim EII tax relief?

You can claim relief once you’ve obtained a ‘Statement of Qualification’ SQEII-3 from the company which you will receive in January of the following year. You must verify that you’ve satisfied all the pertinent investor prerequisites before claiming relief. To proceed with your claim, you must fill out the relevant sections: Income Tax Return Form 11.

When do I get my tax relief?

The 35% tax relief is obtained for the year the investment is made, i.e. for an investment made in 2024, the investor will get 35% relief in his/her 2024 tax return usually filed in 2025.

If I decide to invest, what is the process?

- Simply confirm the amount you wish to invest via e mail and provide us with your address details.

- We can either email or post out an Investor Memorandum and Application Form for you to review and fill out.

- For Anti-Money laundering purposes we will need a certified copy of your ID (passport or driver’s license) as well as proof of address with 2 original utility bills no more than 3 months old.

- Once the docs are signed, payment can be made by cheque or direct transfer into Wild Atlantic Health's nominee holding account.

- In early February we will provide you with an SQEII3 Statement of Qualification on EIIS from Revenue containing your details and the investment amount. This will enable you to claim back the 35% tax refund.

- Your share certificates will also be posted out to you in early February.

Save up to 35% on your Income Tax! Get On Board.

-

A Look at the Your Future

While EIIS investments focus on young companies and come with risks, including the possibility of a total investment loss, spreading your investment across different EIIS opportunities each year can help dilute this risk.

Remember, a four-year exit may not always be on the cards. Also, Capital Gains Tax (CGT) on any profits must be factored into your calculations. The investment structure might offer a fixed rate of return and an exit timeline, much like a loan, or it could be equity-based, meaning higher yet less predictable returns with no guarantee of an exit.

-

Your EIIS Investment Roadmap

- Directly invest with the company: This usually calls for a minimum investment of €5,000 but typically there are no hefty fees and you can deal directly with the Directors supporting entrepreneurs and skipping the middlemen

- Invest through an EIIS fund: Expect a minimum investment of €10,000-€20,000, plus 3% in fees. The payoff includes diversification across 5-10 companies and professional expertise. Remember that it may take 6-9 months for them to invest your money, and some funds might cap the upside gains.

- Invest via a Crowdfunding Platform: These platforms offer EIIS opportunities, with a minimum investment of around €250. This allows you to spread your risk. Some due diligence is performed before listing companies but these tend to be new startups which are more risky and have not been pre-approved by Revenue.